Fdic

Federal deposit insurance corporation fdic.

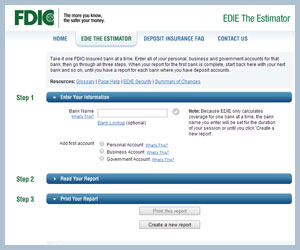

Fdic. Edie is an interactive application that can help you learn about deposit insurance. Branch office deposits branch office deposits. Welcome to the fdics electronic deposit insurance estimator edie. The fdic was.

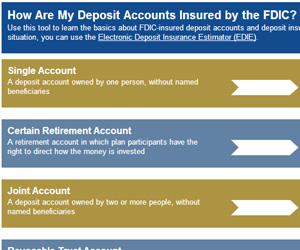

Aggregate data for all fdic insured institutions for each quarter back to 1984 in downloadable excel spreadsheet files. Annual summary of deposits survey of branch office deposits as of june 30. The standard insurance amount is 250000 per. Learn about the fdics mission leadership history career opportunities and more.

All actual claims for deposit insurance shall be governed exclusively by information set forth in the fdic insured institutions records and applicable federal statutes and regulations then in effect. The federal deposit insurance corporation or fdic is a federal government agency that provides insurance to banks. Commercial banks and savings banks. Corporation insuring deposits in the united states against bank failure.

This calculation is based on the deposit insurance regulations in effect as of july 2011. Data is available back to 1994. During the fdic teams extensive outreach and conversations with the fire service there was an overwhelming desire expressed by firefighters to come together in the fall to celebrate the unity of the fire service learn and support ongoing efforts in serving their communities and continue training. The federal deposit insurance corporation fdic is one of two agencies that provide deposit insurance to depositors in us.

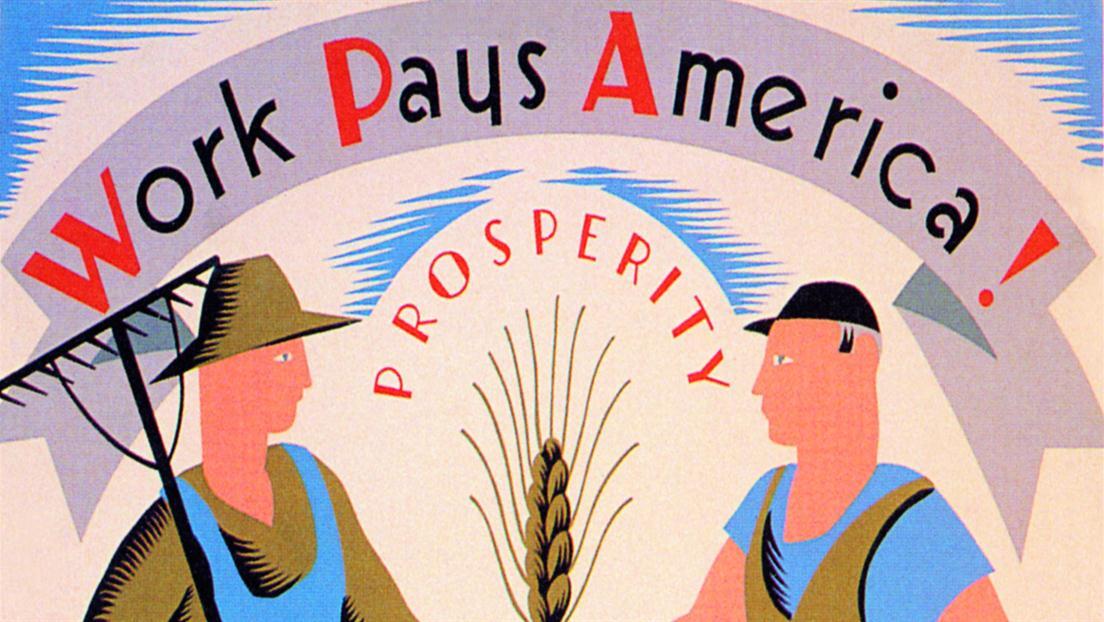

If an insured bank fails then you wont lose the money you keep at that. Learn about the fdics mission leadership history career opportunities and more. The federal deposit insurance corporation fdic is the us. The fdic or federal deposit insurance corporation is an agency created in 1933 during the depths of the great depression to protect bank depositors and ensure a level of trust in the american.

The federal deposit insurance corporation fdic is an independent agency created by the congress to maintain stability and public confidence in the nations financial system.

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)

:max_bytes(150000):strip_icc()/GettyImages-489614604-6cf7c070a91b4ef988255776bd32380f.jpg)